Why ‘Normal’ May Be a Long Way off for The Used Car Market (PDF)

It is a well-known fact that all newly manufactured automobiles eventually lose their “new” status once they are sold. While this may seem like a simple observation, it serves as the fundamental cause of the ongoing challenges facing the used vehicle market in the United States, which has become a barometer for the country’s inflation levels.

The COVID-19 pandemic, which began in early 2020, caused automakers to temporarily halt production to prevent the spread of the virus. This unprecedented action led to additional supply chain issues, including a current shortage of semiconductor chips, which has forced factories to cease production for weeks or even months at a time in recent years.

The reduced production of new vehicles has resulted in a scarcity of used models available for purchase by consumers, leading to inventory constraints and record-high prices due to persistent demand. Although it has been three years since the initial plant closures, consumers and the Biden administration should not expect the used vehicle market to return to pre-pandemic levels anytime soon.

Despite a significant decline in used vehicle prices towards the end of last year, inventories remain significantly depleted due to production disruptions, and there has been a surge of consumers buying out leases to avoid skyrocketing car prices and increasing interest rates.

This situation is likely to persist for some time, as the reduced production of new vehicles has created a situation where wholesale and general used values remain high, given the millions of fewer new vehicles that would eventually turn into used ones.

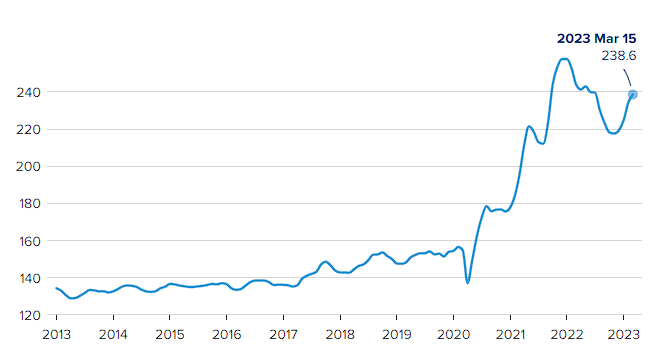

As indicated by the Manheim Used Vehicle Value Index, which monitors auctioned vehicles sold to dealers, wholesale prices for pre-owned cars have surged by 8.8% this year through mid-March, according to Cox Automotive. The trend is upward, and the index is on track to approach the previous record of 257.7 basis points, which was established at the beginning of 2022. As of mid-March, the index stood at 238.6.

Furthermore, the used vehicle inventory has decreased by 21% compared to last year and by 26% from pre-pandemic levels in 2019, with no expectation of returning to the pre-pandemic level of 38.2 million units until at least 2026. Additionally, a change in leasing has further added to the decrease in production. A significant number of consumers have opted to buy out their leased vehicles rather than trading them in, leading to an increase in the residual values of the vehicles.

Cox Automotive previously forecast a 4.3% decrease in wholesale prices on the Manheim Used Vehicle Value Index by the end of 2023 compared to December 2022. However, the company may need to revise this forecast due to the increasing wholesale prices.

As of February, the average listed price of a used vehicle was $26,068, lower than the records set in the previous year but significantly higher than the average of roughly $22,000 reported two years ago. Consumer retail prices generally follow wholesale price changes.

The only solution to the current situation is to increase the production of new vehicles to boost the number of future used models. However, automakers are expected to maintain caution and not overbuild as they have in the past, despite the need for increased production. It is also unlikely that the market will return to pre-pandemic levels due to the current landscape of high prices and decreased production. Automakers have experienced significant profits due to the decreased production, leading to fewer vehicles in the manufacturing process.