Is Ferrari Able to Outrun a US Recession? (PDF)

The luxury carmaker announced last year that it will launch 15 new models over the next four years. The first will be the Purosangue, a hybrid SUV that will debut later this year.

The engine hasn’t slowed down yet. Even Audi’s representatives, his employer at the time, advised Frederic Vasseur to accept the offer of leading a rival Formula 1 team. Ferrari is not a company you turn down when it comes calling. That’s what happens when one of the world’s most famous luxury brands calls you.

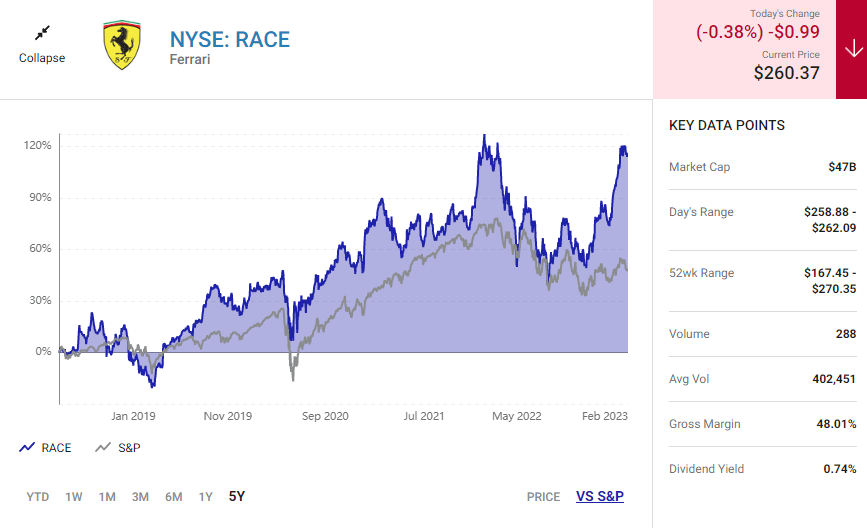

Besides racing, it offers consumer vehicles that are status symbols. Their vehicles range in power from 612 to over 1,000 horsepower and in price from about $225,000 to $2.3 million. After some research, it may be necessary to reverse the idea that a recession in the U.S. would stifle growth for the carmaker.

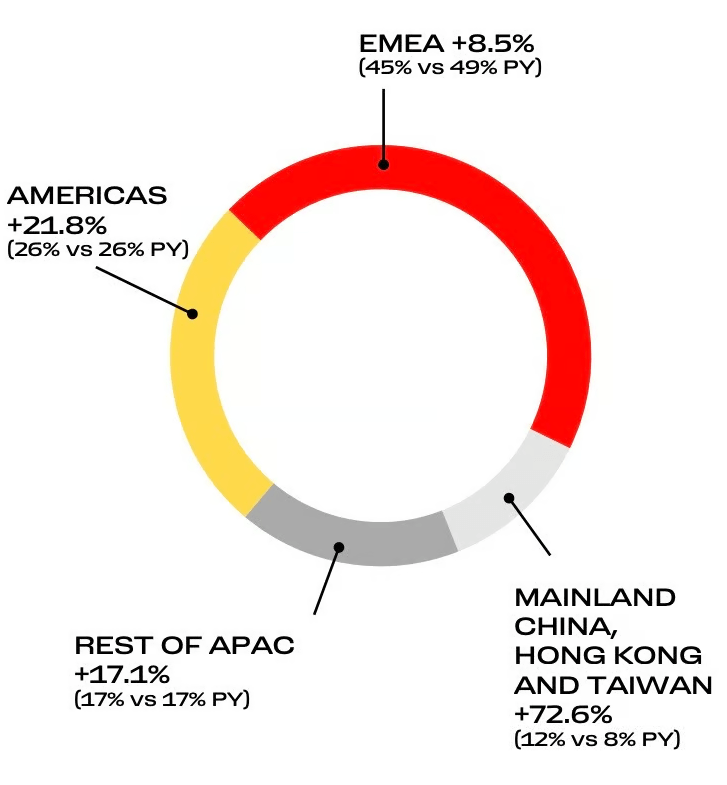

Global reach

Because Ferrari has such a global reach, even if the U.S. economy goes into recession, it can remain on top of things. In the chart, the majority of regions are the EMEA band (Europe, Middle East, and Africa). As an Italian company, it is not surprising that it does the majority of its business in Europe.

Although the company’s growth outside of EMEA has been more robust than within, it has been protected from a North American slowdown some. The European economy has been sluggish for years and Ferrari has grown sales almost three times faster than the GDP of the European Union (EU). This isn’t a perfect apples-to-apples comparison, but it shows that the company isn’t as dependent on economic output as it seems.

Recession-proof

The Great Recession also affected the world’s automotive industry between 2007 and 2009, with global sales falling 11% according to the International Energy Agency. However, few customers have given up on their Ferrari orders due to the usual waiting list of a year or more – some custom models take up to five years to produce.

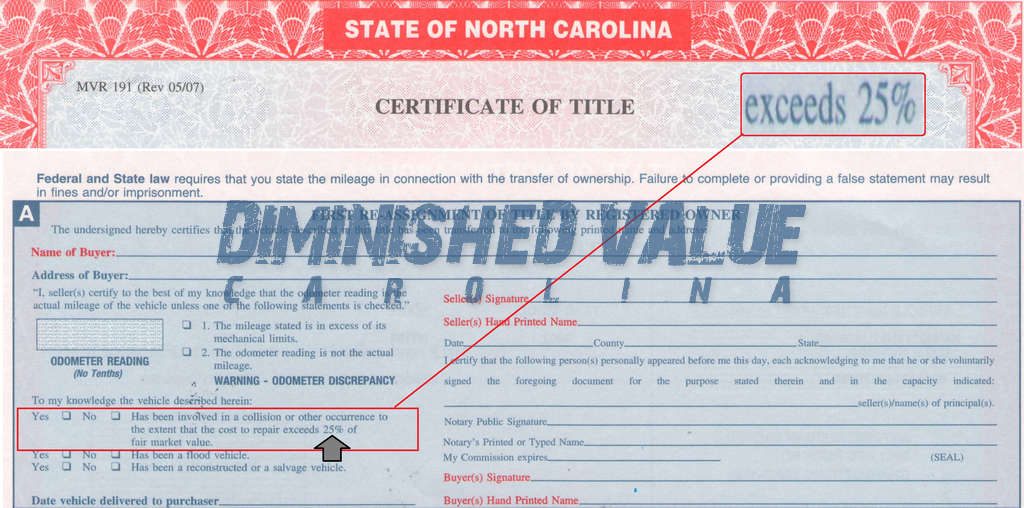

In 2008, Ferrari’s shipments grew by 2% and dropped by only 5% in 2009. That was during the worst recession in history. In an interview at the time, a company executive pointed out the investment properties of the vehicles — older cars can sell for tens of millions of dollars — and implied that customers who relied on Wall Street bonuses for luxury purchases did not have “serious money” like its typical customers.

Stimulate demand, but never give in

In November, the company stopped accepting orders for the Purosangue because the SUV is sold out for the next two years. CEO Benedetto Vigna did not say how many of the white-hot SUVs would eventually be produced. In the meantime, Ferrari has promised to always build one car less than demand. That should protect Ferrari’s brand while keeping sales and profits predictable for the next few years.

Somewhat surprisingly for a company selling 12-cylinder, 1,000-horsepower vehicles, Ferrari also has embraced the EV trend, another potential headwind.

Ferrari says it will launch its first all-electric supercar by 2025 and 80% of its vehicles will be electrified by 2030 — pure electric or hybrid.