In a quaint town where the roads were once dominated by the familiar growl of diesel engines, a silent revolution is brewing. Picture a fleet of sleek, whisper-quiet electric and hydrogen-powered big rigs gliding through the streets. This isn’t a scene from a futuristic movie; it’s the projected reality of America’s highways. The tractor-trailer electrification curve in the U.S. is becoming steeper by the day, signaling a dramatic shift towards Zero Emission Vehicles (ZEVs). But as we envision a future with electric and hydrogen giants ruling the roads, it’s not without its challenges.

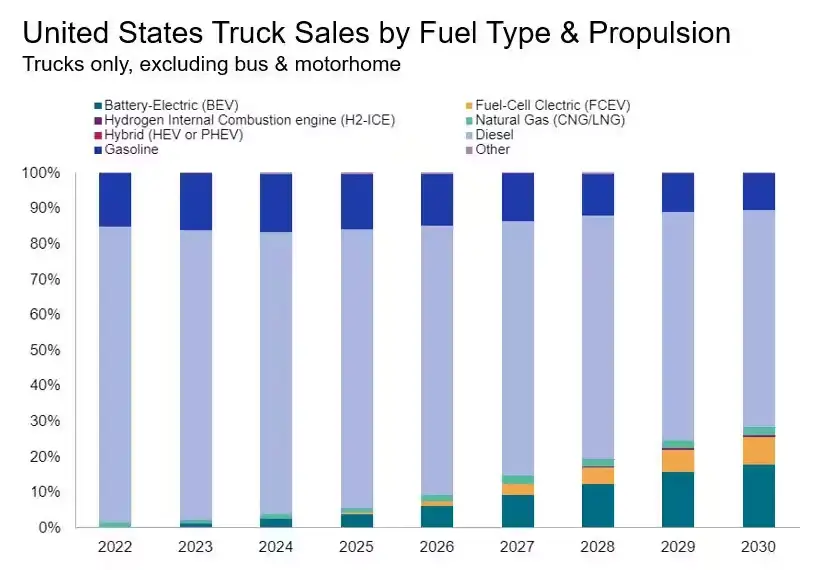

The journey towards ZEV adoption is akin to navigating a road with both exciting prospects and significant potholes. By 2030, emissions regulations are set to become stricter, driving advancements in ZEV technology, particularly in medium- and heavy-duty trucks. Notably, hydrogen is making a notable impact in the ZEV scene. As we look towards this future, medium-term projections for ZEV commercial vehicle registrations are soaring, with an anticipated 140,000 new ZEV trucks annually by 2030, capturing over 25% of the medium- and heavy-duty truck market.

However, shifting to Zero Emission Vehicles (ZEVs) in the commercial trucking industry isn’t without its challenges. While the buzz around new electric and hydrogen trucks is growing, there are still significant hurdles to overcome. Moving away from traditional diesel engines to ZEVs is a major change. This is shown by the rapid increase in the rate of ZEV registrations, jumping from 70% to an impressive 109% growth annually.

How ZEVs Are Transforming Commercial Vehicle Fleet (PDF)

Regulatory Push

Government actions are crucial in steering the shift towards ZEVs. Key initiatives like the Inflation Reduction Act (IRA) and new Greenhouse Gas (GHG) standards are driving the industry towards lower emissions. The IRA, in particular, provides financial incentives like tax credits for businesses investing in clean commercial vehicles. These steps are vital in shaping the future of ZEVs, especially for hydrogen-powered vehicles where fuel costs play a major role in overall expenses.

Despite these incentives, the industry faces substantial challenges. The high price of hydrogen fuel, often exceeding that of diesel, poses a major hurdle for prospective buyers. However, the IRA has raised hopes of reducing hydrogen fuel costs, potentially making them comparable to diesel.

Getting Up to Speed

Despite regulatory efforts, ZEV adoption in the medium- and heavy-commercial vehicle (MHCV) sector has been slower than anticipated. Issues like supply chain disruptions and high production costs particularly affect ZEV startups, who struggle with limited capital and higher borrowing rates.

Dodging Potholes

The practicality of hydrogen fuel for commercial vehicles is still being evaluated. High hydrogen costs present a significant challenge, though incentives from the Inflation Reduction Act (IRA) might lessen this. Nonetheless, the outlook for hydrogen trucks is hopeful, with more models anticipated to hit the market and a notable expected rise in ZEV volumes by 2030.

Demand-side Pledges

Corporate pledges towards carbon neutrality are influencing the shift to ZEVs. Companies with large fleets are increasingly committing to reducing their carbon footprint, with transportation being a key focus area. For example, PepsiCo’s acquisition of Tesla Semis reflects this trend, as do the commitments from other major companies like Amazon and FedEx.

What Needs to Be Done

Aligning regulation, proclamation, and acquisition is essential for a smooth transition to ZEVs. The current slow adoption pace could hinder long-term progress, affecting the viability of new players in the ZEV market. Continuous regulatory push, technological advancements, and economic realities will shape this transition, potentially leading to “Eureka” moments that accelerate ZEV adoption.

In conclusion, as the commercial vehicle fleet accelerates towards ZEV adoption, it’s a journey filled with both promise and challenges. The landscape is changing, driven by regulatory pushes, technological advancements, and corporate sustainability goals. But, will this be enough to overcome the hurdles and fully realize the potential of ZEVs in commercial transportation?