Estimate Your Car’s True Value

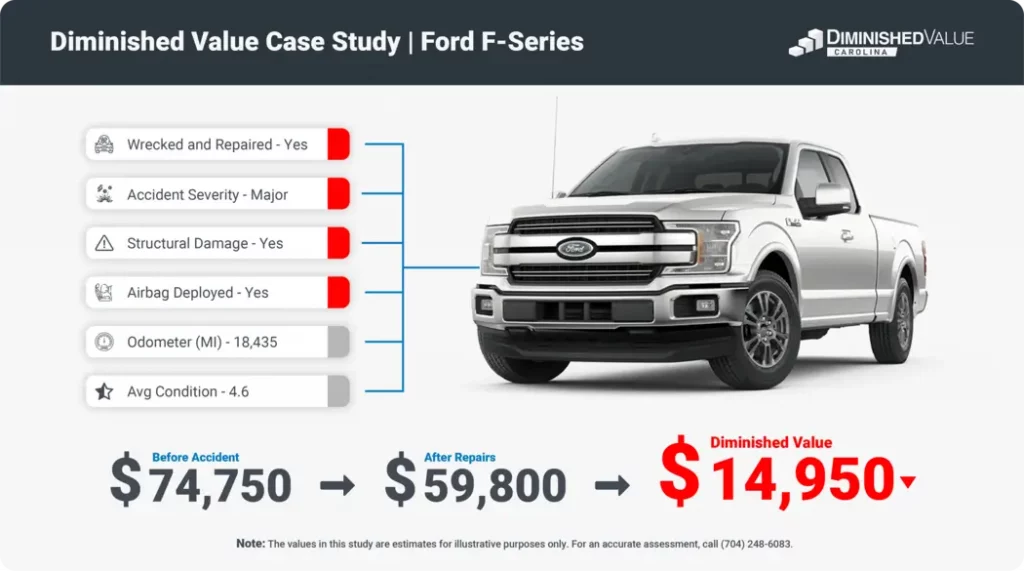

When your car has been involved in an accident, it often loses significant value, even after repairs. This loss, known as diminished value, will affect its resale value, since people are not willing to pay the same amount for a car with an accident history.

After an accident, knowing how much your car’s value has dropped is crucial. Our free Diminished Value Calculator offers a quick and accurate estimate using your VIN. Enter your VIN below to get started.

Diminished Value Calculator

Enter your VIN and discover how much you are owed!

Diminished Value: $0

*$0

*$0

- severe damage

- moderate damage

- minor damage

- no accident

*Fair Market Value / Note: This is only an estimate, please contact us for a more accurate assessment.

FREE Certified Diminished Value Quote

The calculator above is a helpful way to estimate your potential compensation based on the damage. However, many factors influence diminished value. Insurance companies often use the 17c Formula, a flawed method that starts at a 10% reduction and doesn’t account for your specific circumstances (more on this later in the article).

At Diminished Value Carolina we’ve developed our own patent-pending method to calculate your vehicle’s true diminished value. If you want an accurate estimate and to see if you qualify for diminished value, fill out the form below for a free claim review.

What is Diminished Value?

Diminished value is the reduction in a vehicle’s actual cash value after it has been involved in an accident and repaired. It reflects the potential lower resale value due to the history of damage.

While your car might look as good as new after repairs, its accident history remains on the vehicle report, making it less appealing to future buyers.

The Role of a Diminished Value Calculator

Most websites provide a basic overview of diminished value calculators, but there’s more to explore. A diminished value calculator is not just a tool; it’s your key to understanding your car’s actual worth after an accident.

It takes into account multiple factors such as the car’s pre-accident value, the extent of the damage, repair quality, as well as the vehicle’s age, make, and model, giving you a clearer picture of its post-accident market value.

What’s often overlooked is the calculator’s dependence on current market trends and comparable vehicle sales. This detailed approach provides a more precise estimate of your car’s diminished value, ensuring that all key factors influencing the car’s worth are taken into account.

Stats and Insights

Statistically, the diminished value can range significantly. For instance, a luxury car with a high market value may experience a larger absolute loss in value compared to a more common vehicle.

However, the proportional loss might be higher for everyday vehicles, affecting their resale value more critically. This variance underlines the importance of a personalized approach when assessing your car’s value.

Beyond the Diminished Value Calculator: The Next Steps

A diminished value calculator gives a quick estimate, but it’s just the beginning. Filing a claim involves understanding the insurance process, negotiation, and legal considerations. Without a document from a licensed company proving what your car lost in value, these diminished value calculators are of no value to the insurance company.

This is where a professional appraisal company becomes essential. They handle the complexities of claims and ensure you get fair compensation. While the calculator provides a number, a professional turns that number into real results.

How To File a Diminished Value Claim

Filing a diminished value claim might sound complex, but it doesn’t have to be. We’ve broken it down into a step-by-step guide that’s easy to follow while maintaining professionalism:

Step 1: Gather Information

Start by collecting all relevant information about the accident. This includes accident reports, repair invoices, and any photographs of the damage. The more documentation you have, the stronger your claim will be.

Step 2: Contact Your Insurance Company

Next, contact your insurance company. Let them know about the accident and your intention to file a diminished value claim. They will provide guidance and necessary forms for the process. Clear communication is essential, so feel free to ask questions for clarity.

Step 3: Consult a Professional Appraisal Company

Remember, the insurance company is not your friend! Consider enlisting the help of a professional appraisal company like Diminished Value Carolina. We can provide a comprehensive assessment of your vehicle’s diminished value, which is a crucial piece of evidence for your claim.

The average diminished value amount is $6,200. We can help you get what you deserve.

Step 4: Understand Your State’s Laws

Each state has different regulations regarding diminished value claims. Familiarize yourself with your state’s laws to ensure you’re following the correct process.

Step 5: Prepare a Formal Demand Letter

Write a formal demand letter to your insurance company. This letter should include all the evidence you’ve gathered, your diminished value assessment, and a clear request for compensation.

When you hire us we’ll provide you with all document templates and personal assistance so you can get the most out of your claim.

Step 6: Negotiate

Be prepared to negotiate with your insurance company. They may offer an initial settlement that you can either accept or negotiate further. A professional appraisal can be invaluable during this process.

Step 7: Get Your Compensation

After finalizing the claim, you should receive your compensation for the diminished value of your vehicle and recover your losses.

The 17c Formula is Unfair for Diminished Value Calculations

Many insurance companies, including USAA, rely on the 17c Formula to calculate diminished value after an accident. However, this method is widely criticized for being unfair to vehicle owners.

The 17c Formula caps the loss at 10% of the car’s pre-accident value, without considering factors like the vehicle’s condition or market demand.

Flaws in the 17c Formula

- Geographical Inaccuracy: The formula doesn’t account for varying vehicle resale values based on location.

- Arbitrary 10% Base Loss: The 10% assumed lost value isn’t based on facts and ignores differences in vehicle types.

- Oversimplified Damage Modifier: The formula’s focus on structural damage underestimates actual loss.

- Redundant Mileage Modifier: Mileage is factored twice, which lowers the calculated value, especially for vehicles over 100,000 miles.

These flaws can significantly skew diminished value calculations, leading to lower compensation. For a more accurate and fair assessment, it’s crucial to get an independent appraisal.

This ensures that you receive proper compensation reflective of your car’s true diminished value.

Conclusion

Understanding the diminished value of your car after an accident goes beyond just numbers—it’s about recognizing the hidden loss and ensuring you receive the compensation you deserve.

While a diminished value calculator provides a helpful starting point, having the support of a professional appraisal company like Diminished Value Carolina can significantly strengthen your claim.

Want to uncover the real loss in value of your car? Take advantage of our free diminished value estimate today and get the compensation you’re entitled to.