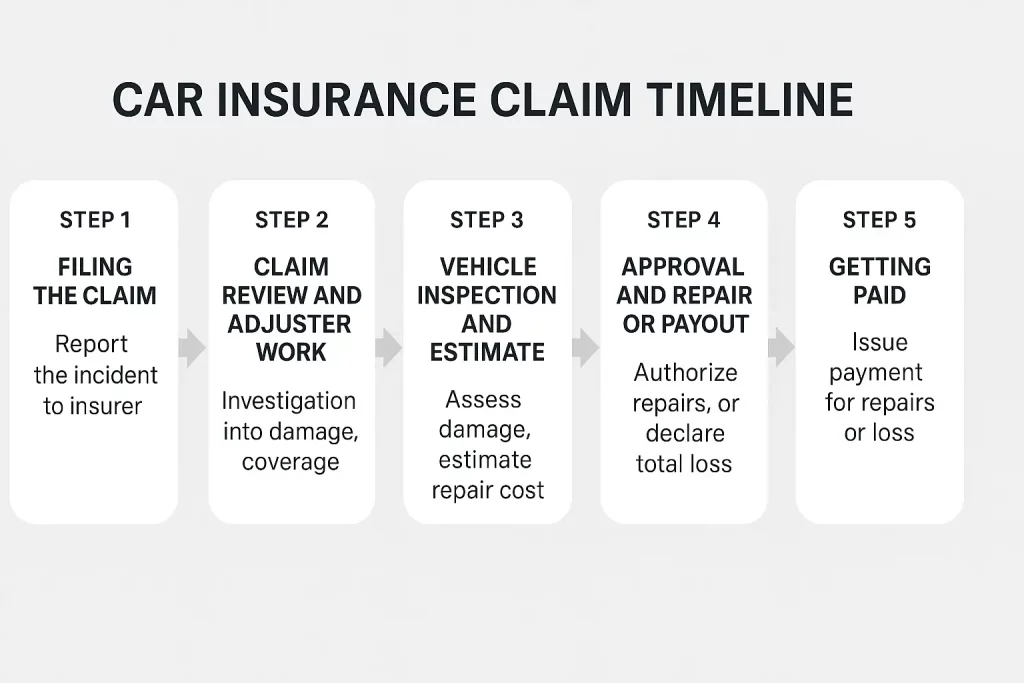

After a car crash, most people wonder how long their insurance claim will take. The answer depends on many things—like how bad the damage is, how fast you report it, and how quickly your insurer works. Still, the process follows a clear order.

This article will walk you through the full car insurance claim timeline, step by step. You’ll learn how claims start, what slows them down, and how long each part takes. If you understand the timeline, you’ll know what to expect and how to avoid delays.

When a Claim Starts

A claim begins after your car is damaged or lost. This can be because of a crash, theft, hail, or even hitting an animal. You should report the problem to your insurer right away. Most companies let you file online, by phone, or through an app.

The faster you report it, the better. But speed isn’t everything. You need to give good details too. That includes photos of the damage, contact info from others involved, and a police report if there is one. This helps your insurer start the claim with all the facts.

Step 1: Filing the Claim

This is the first step. You send your report to the insurance company. That’s when the clock starts. You’ll give them:

- The date and time of the crash

- What happened

- Photos or videos

- Any police info you have

Once the company has this, they’ll open a case for you.

Step 2: Claim Review and Adjuster Work

After you file, your claim goes to an auto appraiser. This person looks at what happened. They decide who’s at fault, what’s covered, and how much the damage is worth.

The appraiser may:

- Call you or other people involved

- Look at police or witness reports

- Ask for more photos or info

If the crash is simple, this can be fast. If it’s messy, it may take longer.

Step 3: Vehicle Inspection and Estimate

Next, your car gets inspected. This could be in person or from photos. Sometimes, your insurer sends you to a repair shop for a full check.

The shop or adjuster writes an estimate. If it costs too much to fix, your car may be a total loss. That means the repairs cost more than the car is worth.

Step 4: Approval and Repair or Payout

Once the damage is clear, your insurer will do one of two things:

- Approve the repair

- Declare the car a total loss

If it gets fixed, they’ll send the car to a shop and pay for the work. If it’s totaled, they’ll offer you money based on your car’s value before the crash.

Small repairs can take a week. Big ones take longer. A total loss claim takes time too, especially if there’s a loan involved.

Step 5: Getting Paid

After repairs are done—or a total loss is settled—you get your money. It can go straight to the shop or to you, depending on how you set it up. If your car is financed, some or all of it may go to your lender.

Most payouts happen within 3 to 10 business days after everything is approved.

How Long Does It All Take?

There’s no exact answer. But here’s a simple look:

- Small accident, no injuries: 1–2 weeks

- Medium damage: 2–4 weeks

- Total loss or injury cases: 3–6 weeks, sometimes longer

Some states have laws that say insurers must finish claims in 30 to 45 days—but that’s not always guaranteed.

What Slows Things Down?

Claims slow down for many reasons:

- You forget to send documents

- The other driver doesn’t reply

- Shops are busy or waiting on parts

- There’s a fight over who’s at fault

- Your adjuster can’t get what they need

If another insurance company is involved, that can also slow things down.

How You Can Help Speed It Up

You can’t control everything, but you can help:

- Report the claim right away

- Give full and clear info

- Answer your phone or emails fast

- Ask for updates

- Use shops your insurer prefers (they work faster)

Staying in touch makes a big difference.

Final Thoughts: Navigating the Car Insurance Claim Timeline

The car insurance claim timeline follows a clear path. You file the claim, your insurer reviews it, they look at the damage, approve repairs or payout, and then you get your money. It sounds simple, but many things can affect how long it takes.

Some claims finish in a week. Others take a month or more. But if you give your insurer the info they need and follow up as needed, you’ll keep things moving. Knowing the process makes it easier to handle—and helps you get back on the road sooner.