Unraveling the Surge in US Car Insurance Prices (PDF)

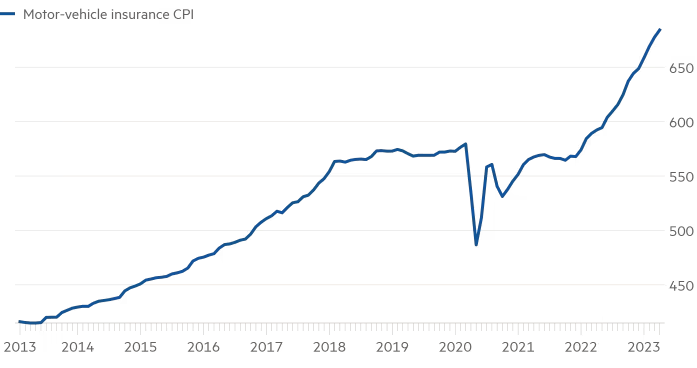

If you’re a first-time car purchaser in the US this month, gearing up to leave a major city, you might find yourself facing an unexpected hurdle: soaring car insurance prices. While insurance has typically been an afterthought for many car owners, this year it has become a significant concern. In fact, you may even need to delay driving your new vehicle while you shop around for a reasonably priced policy. The reason behind this surge in prices lies in the struggles faced by US auto insurers, who have been grappling with losses in underwriting policies, leading to substantial increases in premiums.

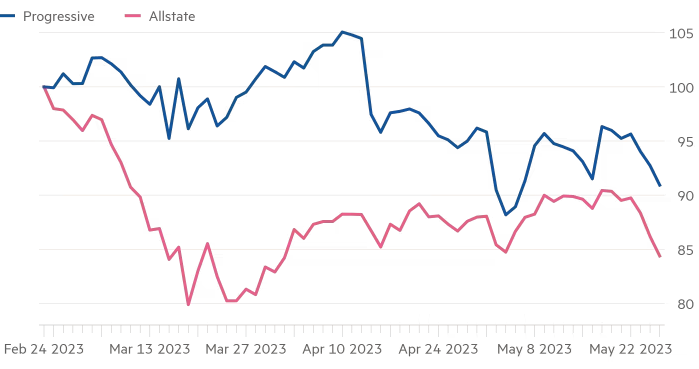

Companies heavily invested in the auto insurance business, excluding those backed by Warren Buffett’s support, are beginning to feel the impact. Take Allstate and Progressive, for instance:

The Impact on Insurance Companies

While it’s not yet complete market mayhem, the situation is far from ideal. Fitch Ratings recently downgraded Allstate’s credit rating to BBB from A-, citing auto-policy underwriting losses as a primary reason. Allstate also raised $600 million by selling preferred shares earlier in the month, with a 7.375% yield, indicating that the management is comfortable at a lower rating, according to BMO analysts.

Progressive, on the other hand, is faring slightly better, according to analysts at CreditSights. However, they remain pessimistic about the overall industry, highlighting that the significant decline in miles driven during the pandemic was followed by a surge in inflationary pressures.

The profitability challenges faced by auto insurers primarily stem from unexpected increases in the severity of accidents, rather than an increase in accident frequency. In other words, insurers are not paying out claims more frequently, but the average cost per claim has risen substantially.

Rising Vehicle Prices and High Demand

The rising prices of vehicles and high demand have played a significant role in the long-term trend of increasing auto insurance costs. According to the Manheim Used-Vehicle Index, used-car prices were, on average, 8% higher in 2022 compared to the previous year, though they have stabilized somewhat since December. The cost of replacements for totaled vehicles and repairs has also risen due to increased prices of car parts and services, as reported by the Bureau of Labor Statistics.

However, the root causes may extend beyond supply-chain problems and labor costs. Progressive’s first-quarter data revealed significant increases in the severity of accidents in the categories of “bodily injury” and “property damage,” particularly in accidents where the insured driver was found to be at fault. Allstate’s Mario Rizzo mentioned a higher percentage of total losses in accidents during the first quarter, offsetting the stabilization of auto prices.

It seems that victims of car wrecks and their lawyers are becoming more aggressive, leading to higher claims costs. Moreover, there might be a puzzling trend of wrecks becoming rarer but more severe. In response to these challenges, executives from both Allstate and Progressive have openly discussed raising prices. Allstate reported a 22% drop in new insurance applications in the first quarter, especially in states where rate increases have faced opposition.

Despite these efforts, the “combined ratio,” a metric used to assess the profitability of auto underwriters, indicates that Allstate continued to incur losses on its auto underwriting in the first quarter, while Progressive barely managed to eke out a profit.

The Path Forward: Balancing Profitability and Affordability

Overall, the surge in car insurance prices in the US can be attributed to a combination of factors, including rising vehicle prices, higher demand, increased costs of repairs and replacements, and unexpected rises in accident severity. Insurers are grappling with these challenges as they strive to balance their underwriting losses and maintain profitability. While the situation has yet to become a tale of “greedflation” for auto insurers, it is clear that industry-wide adjustments are necessary to navigate these troubled waters and provide affordable coverage for American drivers.