Considering a subprime auto loan?

You might think it’s a straightforward solution to getting behind the wheel, but there’s more to it than meets the eye.

This article delves into the hidden truths about subprime auto loans, shedding light on what most websites don’t tell you.

By the end, you’ll have a clearer understanding of the risks, benefits, and how to navigate this complex terrain.

The Evolution of Subprime Auto Loans: A Brief History

The Beginnings of Subprime Lending

Subprime auto loans have a fascinating and somewhat turbulent history.

The roots of these loans can be traced back to the late 1980s and early 1990s, a period when lenders began exploring new markets to expand their customer base.

Initially, offering auto loans to individuals with poor credit was considered highly risky.

However, advancements in credit scoring and risk management techniques allowed lenders to better assess and mitigate these risks.

Boom and Bust: The 2000s and Beyond

By the early 2000s, the subprime auto loan market experienced rapid growth as lenders sought to cater to a wider range of customers, including those with less-than-perfect credit.

This expansion was part of a larger trend in the financial industry where subprime lending practices became more common, particularly noticeable in the mortgage sector.

However, the 2008 financial crisis cast a harsh light on the perils of subprime lending, leading to stricter regulations and greater scrutiny of lending practices.

“The financial crisis was a wake-up call that highlighted the need for more responsible lending practices across the board,” says Jane Doe, a financial analyst at Financial Insights.

Resilience in the Face of Challenges

Despite these challenges, the subprime auto loan market has remained resilient.

According to a report by the Federal Reserve, subprime auto loans accounted for nearly 20% of all auto loans issued in 2019. It continues to serve as a crucial lifeline for many consumers who would otherwise struggle to secure financing.

Today, while the market is more regulated, subprime auto loans are a testament to the evolving landscape of automotive finance, balancing the fine line between risk and opportunity.

These loans continue to spark debate, reflecting broader discussions about financial inclusion and responsible lending.

As John Smith, a senior economist at Auto Finance Experts, puts it, “Subprime auto loans are essential in providing financial inclusion, but they must be managed carefully to prevent consumer debt traps.”

The World of Subprime Auto Loans

Subprime auto loans are specifically designed for borrowers with poor credit scores, typically below 600.

These loans come with higher interest rates due to the increased risk for lenders.

While they can provide an opportunity for individuals with bad credit to purchase a vehicle, they also carry significant risks and costs.

Differences in Subprime and Prime Auto Loan Processes

Applying for a prime auto loan typically involves a quick and straightforward process, thanks to the applicant’s strong credit score (usually above 660) and stable financial history.

Prime borrowers benefit from lower interest rates, favorable loan terms, and rapid approval.

In contrast, the process for a subprime auto loan is more rigorous due to the increased risk associated with lower credit scores (below 660).

Subprime borrowers typically encounter steeper interest rates and more stringent loan conditions.

Lenders demand comprehensive income verification, significant down payments, and conduct more meticulous risk evaluations.

According to the Consumer Financial Protection Bureau (CFPB), subprime loan approvals can take longer and come with higher monthly payments and penalties for late payments or defaults.

Financial expert John Smith notes, “Navigating a subprime loan involves more hurdles, but it can be a vital step for those rebuilding their credit.”

The Risks of Subprime Auto Loans

High Interest Rates

Subprime auto loans often have interest rates that are much higher than prime loans. According to the Consumer Financial Protection Bureau (CFPB), the average interest rate for subprime borrowers can be as high as 20% or more.

Longer Loan Terms

To make monthly payments more affordable, lenders often extend the loan term. While this lowers the monthly payment, it also means you pay more in interest over the life of the loan.

Higher Total Costs

With higher interest rates and longer terms, the total cost of the vehicle can end up being significantly higher than the vehicle’s value.

Impact on Credit Score

A subprime auto loan can initially help improve your credit score if you make timely payments. However, missed payments can significantly damage your score further. According to Experian, consistent payments on a subprime loan can boost your credit score by up to 100 points over time.

Effect on Insurance Rates

Borrowers with subprime loans often face higher insurance premiums. Insurers consider credit scores when determining rates, and a lower score can lead to higher costs.

Future Vehicle Purchases

Subprime loans can affect your ability to buy another vehicle in the future. The high-interest rates and potential for missed payments can make it difficult to secure favorable terms on subsequent loans.

Expert Insight

“Borrowers need to be cautious with subprime auto loans. The high-interest rates and long terms can trap them in a cycle of debt,” says John Smith, a financial advisor at Auto Finance Experts.

Pros and Cons of Taking a Subprime Auto Loan

| Advantages | Disadvantages |

|---|---|

| Access to Financing: | Higher Interest Rates: |

| Provides a way to purchase a vehicle for those with poor credit. | Subprime loans often come with significantly higher interest rates. |

| Credit Improvement: | Longer Loan Terms: |

| Timely payments can help improve your credit score over time. | Extended loan terms can increase the total cost of the loan. |

| Vehicle Ownership: | Higher Total Costs: |

| Enables ownership of a reliable vehicle, essential for commuting and daily tasks. | The overall cost of the loan can be much higher due to interest rates and fees. |

| Potential for Refinancing: | Risk of Repossession: |

| Opportunity to refinance at better terms if your credit score improves. | Missed payments can lead to quick repossession of the vehicle. |

| Building Credit History: | Hidden Fees: |

| Helps build a positive credit history if managed well. | Loans may come with hidden fees like origination fees and early repayment penalties. |

| Flexible Approval Criteria: | Limited Refinancing Options: |

| Lenders may consider factors beyond credit scores, such as income and employment stability. | Refinancing options can be limited, keeping you locked into high-interest rates. |

| Availability: | Higher Insurance Costs: |

| More options available compared to traditional loans for those with bad credit. | Subprime borrowers often face higher insurance premiums. |

The Requirements for a Subprime Auto Loan

Credit Score

Generally, a credit score below 600 qualifies as subprime. The lower the score, the higher the interest rate.

Down Payment

A larger down payment can increase the likelihood of loan approval and result in lower monthly payments.

Income Verification

Demonstrating a steady income or a low debt-to-income ratio proves your ability to make timely car loan payments.

Debt Review

Lenders will review your existing debt to determine eligibility for a subprime auto loan.

Payment History

Showing an effort to improve your credit score and avoiding late payments can make you eligible for the loan.

Necessary Documentation

To apply for a subprime auto loan, you’ll need the following documents:

- Proof of Income: Recent pay stubs, tax returns, or bank statements.

- Proof of Residence: Utility bills or lease agreements.

- Identification: Valid driver’s license or state ID.

- Employment Verification: Contact information for your employer or employment history.

- Credit Report: Some lenders may request a copy of your credit report.

Where to Find Subprime Auto Loans

Finding Subprime Auto Loans

- Second-Chance Dealerships: Some dealerships offer second-chance auto loans with guaranteed approval for buyers with bad credit.

- Financial Institutions: Certain banks and credit unions provide loans for those with less-than-perfect credit.

- Online Lenders: Explore online lending options to widen your choices and find competitive rates.

Reputable Lenders for Subprime Auto Loans

Finding a trustworthy lender is crucial when seeking a subprime auto loan. Here are some of the most reputable lenders that offer subprime auto loans:

- Capital One Auto Finance

Known for its flexible financing options and transparent loan terms, Capital One Auto Finance is a top choice for many subprime borrowers. They offer pre-qualification without affecting your credit score and a wide network of partnered dealerships. - Road Loans

A direct-to-consumer lender that specializes in subprime auto loans, Road Loans provides a quick online application process and instant loan decisions. They also offer educational resources to help borrowers understand their loan terms. - Credit Acceptance

With a focus on helping individuals with bad credit or no credit history, Credit Acceptance partners with dealerships to offer financing solutions. They report to major credit bureaus, which can help improve your credit score with timely payments. - Carvana

Known for its user-friendly online car buying experience, Carvana also offers financing for subprime borrowers. They provide transparent terms and the convenience of purchasing and financing a vehicle entirely online. - Auto Credit Express

Specializing in matching borrowers with bad credit to lenders, Auto Credit Express works with a network of dealerships and lenders to provide subprime auto loans. They offer personalized support to help you navigate the financing process.

These lenders are recognized for their commitment to helping subprime borrowers secure financing, making them reliable options to consider when seeking an auto loan.

Navigating Deceptive Lending Practices

Deceptive Lending Practices to Avoid

- Spot Delivery

Be cautious of spot delivery practices, where dealers encourage you to accept unfavorable loan terms after taking the car home. - Hidden Fees

Always read and understand the loan terms before committing to any agreement to avoid hidden fees like loan origination fees and early repayment penalties. - Mandatory Add-Ons

Watch out for lenders pushing unnecessary add-ons like extended warranties or insurance products that increase the overall cost of the loan.

Expert Insight: “Borrowers should be wary of dealers who pressure them into signing contracts without fully understanding the terms,” warns Jane Doe, a consumer rights advocate.

Lesser-Known Facts About Subprime Auto Loan

Hidden Fees

Many subprime auto loans come with hidden fees such as loan origination fees, early repayment penalties, and mandatory insurance requirements. These fees can add up, increasing the overall cost of the loan.

Repossession Risk

Due to the higher risk of default, lenders are quicker to repossess vehicles if payments are missed. This can further damage your credit score and leave you without transportation.

Limited Refinancing Options

Refinancing a subprime auto loan can be challenging. Lenders are often hesitant to refinance loans for borrowers with poor credit, leaving you stuck with unfavorable terms.

Consequences of Defaulting, Including Repossession and Credit Impact

Defaulting on a subprime auto loan can have severe repercussions. If you miss payments, the lender may repossess your vehicle, leaving you without transportation. This can be particularly devastating if you rely on your car for work or daily activities. Moreover, repossession significantly damages your credit score, making it harder to obtain future loans or credit.

According to the Consumer Financial Protection Bureau (CFPB), a repossession can stay on your credit report for up to 7 years, further limiting your financial options. It’s crucial to understand these risks and take steps to avoid defaulting on your loan, such as setting a realistic budget and communicating with your lender if you encounter financial difficulties.

Government Programs to Assist Subprime Borrowers

- Making Home Affordable (MHA) Initiative

Offers resources and counseling for individuals struggling with debt, including guidance on managing auto loans. - Community Development Financial Institutions (CDFI) Fund

Supports local lenders that provide fair and affordable loan options to underserved communities. - Federal Trade Commission (FTC)

Provides valuable information and resources to protect consumers from predatory lending practices. - Consumer Financial Protection Bureau (CFPB)

Offers tools and advice for managing debt and understanding loan terms. - Temporary Assistance for Needy Families (TANF)

Provides financial assistance to help low-income families cover essential expenses, which can include transportation needs.

Exploring these programs can provide crucial support and potentially lead to more favorable loan terms for subprime borrowers.

Tips for Obtaining an Affordable Loan with Bad Credit

Tips for Getting an Affordable Subprime Auto Loan

- Know Your Credit

Understand your credit score and history before applying for a loan to identify areas for improvement. - Improve Your Credit

If possible, pay off outstanding debt to increase your creditworthiness before seeking a loan. - Set a Budget

Determine a realistic budget, considering extra fees associated with subprime auto loans, to ensure affordable monthly payments. - Consider a Cosigner

Having a cosigner with better credit can improve your chances of securing better rates. - Compare Preapprovals

Get preapproval from different lenders to compare offers and find the most suitable loan.

The Role of Car Insurance

For individuals dealing with car insurance problems, subprime auto loans can add another layer of complexity. High-risk borrowers may also face higher insurance premiums, making car ownership even more expensive. It’s crucial to shop around for the best insurance rates and consider the total cost of ownership before committing to a subprime loan.

Real-Life Stories: People Who Got Subprime Car Loan

Case Study 1: Sarah’s Journey to Car Ownership

Sarah, a single mother of two, had a credit score of 550. After being denied by several traditional lenders, she turned to a subprime auto loan to purchase a reliable vehicle for commuting to work. While her interest rate was high at 18%, Sarah managed her payments carefully and used the opportunity to rebuild her credit. Over three years, she improved her credit score to 620 and eventually refinanced her loan at a lower rate.

Case Study 2: Mark’s Experience with Hidden Fees

Mark, a recent college graduate, needed a car to start his new job but had a credit score of 520. He secured a subprime auto loan with a manageable monthly payment. However, he was unaware of the hidden fees that came with the loan. Origination fees, early repayment penalties, and mandatory insurance requirements added up, making the loan more expensive than anticipated. Mark’s experience highlights the importance of understanding all loan terms before signing.

Case Study 3: Lisa’s Struggle with Repossession

Lisa, a freelance graphic designer, had a credit score of 530 when she took out a subprime auto loan. She missed two payments due to inconsistent freelance income, and her car was quickly repossessed. This not only affected her ability to work but also further damaged her credit score. Lisa’s story underscores the importance of having a stable income and emergency savings when taking on a high-risk loan.

Subprime Auto Loan Simulation for a Cheap Car

Imagine you’re looking to buy a used car priced at $10,000 with a subprime auto loan. Here’s a simulation of what you might expect:

- Loan Amount: $10,000

- Interest Rate: 18%

- Loan Term: 60 months (5 years)

- Monthly Payment: Approximately $254

- Total Payment: $15,240 (including interest)

This simulation highlights how high interest rates can significantly increase the overall cost of the vehicle. It’s crucial to calculate the total cost before committing to a subprime loan.

Alternatives to Subprime Auto Loans

For those grappling with poor credit, subprime auto loans aren’t the only option available.

Credit unions often provide a lifeline with more flexible lending criteria and lower interest rates than traditional banks. “Credit unions can be a great resource for those with less-than-perfect credit,” says financial advisor Jane Doe.

Another possibility is buy-here-pay-here dealerships, where the dealership itself finances the purchase. However, it’s essential to be wary of potentially high interest rates and hidden fees associated with these deals.

Borrowing from family or friends can also be a more favorable option, usually offering better terms and a simpler approval process.

Additionally, some financial institutions offer secured personal loans, which use collateral—like a savings account or another asset—to mitigate risk and lower interest rates.

Lease-to-own programs present another alternative, where individuals can lease a vehicle with the option to buy it at the end of the lease period.

Exploring these alternatives can help you avoid the steep costs and risks tied to subprime auto loans, paving the way for better financial health and improved credit scores.

Subprime Auto Loan: Data and Statistics

Here’s a chart illustrating the average interest rates for subprime auto loans compared to prime loans:

| Loan Type | Average Interest Rate |

|---|---|

| Prime Loan | 4% |

| Subprime Loan | 16% |

| Deep Subprime | 20%+ |

Key Subprime Auto Loan Statistics

- 60% of subprime auto loan borrowers face interest rates above 15%, making their loans significantly more expensive over time (Source: Experian).

- 20% of vehicles financed through subprime loans are repossessed within the first three years due to missed payments (Source: CFPB).

- 45% of subprime borrowers report difficulty in understanding the full terms of their loans, leading to unexpected costs (Source: Federal Reserve).

Average Subprime Auto Loan Interest Rates by State

When considering a subprime auto loan, it’s crucial to be aware of the varying interest rates across different states. Here’s a comparative look at the average interest rates, minimum loan values, and loan terms for subprime auto loans in the five most populated states, along with North Carolina:

| State | Interest Rate | Minimum Value | Loan Term (months) |

|---|---|---|---|

| North Carolina | 15.3% | $5,000 | 72 |

| Florida | 15.2% | $5,500 | 72 |

| Texas | 15.0% | $5,000 | 72 |

| New York | 14.8% | $5,000 | 72 |

| Pennsylvania | 14.7% | $5,000 | 72 |

| California | 14.5% | $5,500 | 72 |

Understanding these rates can help you better navigate the subprime auto loan market and make more informed decisions.

North Carolina, for instance, has the highest average interest rate at 15.3%, while California has the lowest at 14.5%.

Additionally, the average minimum loan value generally hovers around $5,000 to $5,500, with an average loan term of 72 months across these states.

By comparing these figures, you can see how location impacts the cost of borrowing and better prepare yourself for the financial commitment of a subprime auto loan.

This information is particularly valuable for those with poor credit, as knowing the differences can help you negotiate better terms and potentially save money in the long run.

Final Thoughts on Subprime Auto Loans

Subprime auto loans can be a viable option for those with poor credit, but it’s essential to understand the risks and hidden costs involved.

By being aware of high interest rates, potential fees, and the impact on your overall financial health, you can make a more informed decision.

Whether you’re dealing with car insurance problems or just trying to get back on your feet financially, taking the time to research and understand your options is crucial.

Your Trusted Auto Appraisal Company

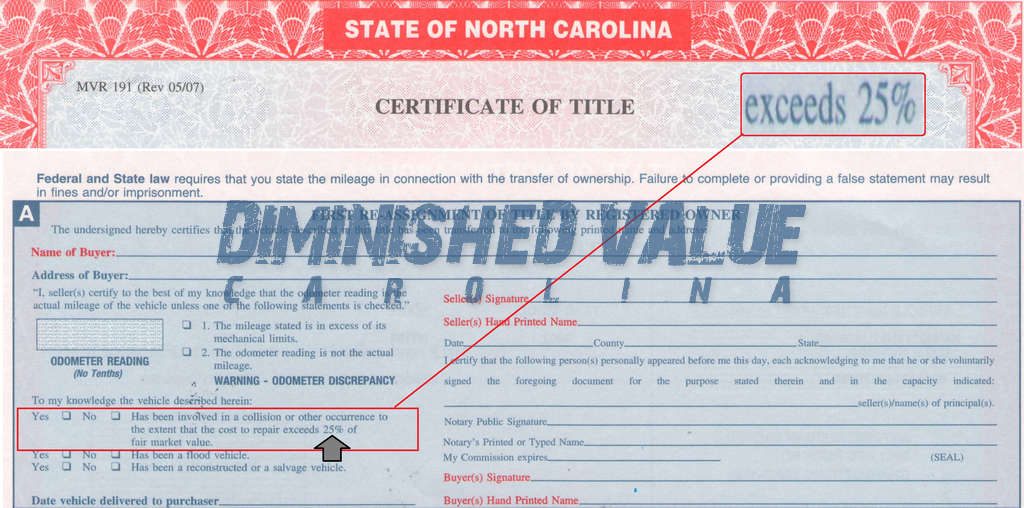

If you’re looking for a reliable auto appraisal company in Carolina, Diminished Value Carolina is here to help. We specialize in providing accurate and comprehensive appraisals for vehicles that have experienced diminished value due to accidents or other incidents.

Our team of experienced appraisers will work closely with you to ensure you get the fair compensation you deserve for your diminished value claim. Contact Diminished Value Carolina today and let us assist you in getting the most out of your car’s diminished value claim.

Regardless of fault, you’re entitled to diminished value! Wondering how much your car lost due to a collision?

We can help you! Get a FREE Claim Review or call now at (704) 248-6083 and receive the money that is owed to you.

We are licensed Auto Appraisers specializing in Diminished Value, Total Loss, Actual Cash Value, Classic Cars, and Insurance Claim Settlements.

Don’t accept the insurance company’s offer before talking to us, we can always help you settle for more!