North Carolina Insurance Law: The Obligation to Pay the Undisputed Amount (PDF)

North Carolina requires all drivers to carry liability insurance to cover any damages or injuries they may cause in a car accident. If a driver is at fault in an accident, their insurance company is responsible for paying the other driver’s damages and medical expenses, up to the policy limit. However, it is important to understand your rights and obligations under North Carolina’s insurance laws if you are involved in a car accident.

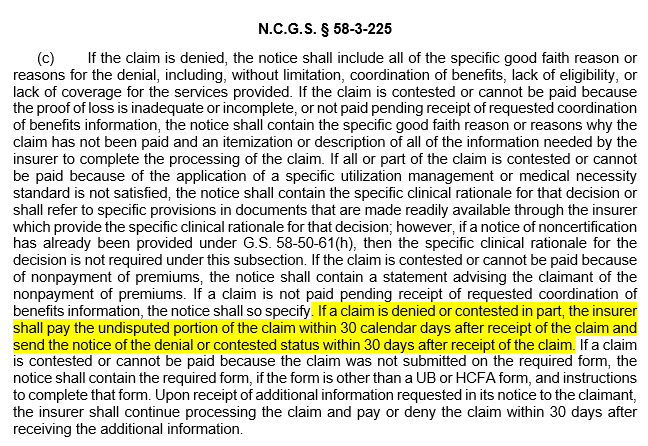

One important provision of North Carolina General Statutes section 58-3-225 is subsection (c), which requires insurers to pay the undisputed amount of a claim within 30 days. If an insurer receives a valid claim for payment of an undisputed amount, the insurer must either pay that amount or notify the claimant of the insurer’s intention to contest the claim within 30 days. Failure to do so may entitle the insured to interest on the amount owed, as well as attorney’s fees and court costs.

It is important to note that this section of the law only applies to the undisputed amount of a claim, and does not apply if the insurer has a valid reason for disputing the claim. If there is a question as to whether the accident was caused by the insured or by another driver, the insurer may need to investigate further before making a payment. In this case, the insurer must provide a written explanation for the dispute and the reasons for the delay in payment.

If you are involved in a car accident in North Carolina and have filed a claim with your insurance company, it is crucial to keep track of the timeline for payment. If the insurer fails to pay the undisputed amount within 30 days, you may be entitled to interest on the amount owed, as well as attorney’s fees and court costs. However, if there is a dispute over the claim, you may need to seek legal assistance to resolve the issue and obtain full payment for your damages and injuries.

Overall, North Carolina’s insurance laws require insurers to act in good faith and deal fairly with their policyholders. This means paying the undisputed amount of a claim within 30 days. If you are involved in a car accident in North Carolina, it is essential to understand your rights and obligations under the law and to seek legal assistance if necessary to resolve any disputes over your insurance claim. By doing so, you can ensure that you receive fair compensation for your damages and injuries.