NCGS 20-279.21 – North Carolina Diminished Value Statute

Such motor vehicle liability policy shall state the name and address of the named insured, the coverage afforded by the policy, the premium charged therefor, the policy period and the limits of liability, and shall contain an agreement or be endorsed that insurance is provided thereunder in accordance with the coverage defined in this Article as respects bodily injury and death or property damage, or both, and is subject to all the provisions of this Article.

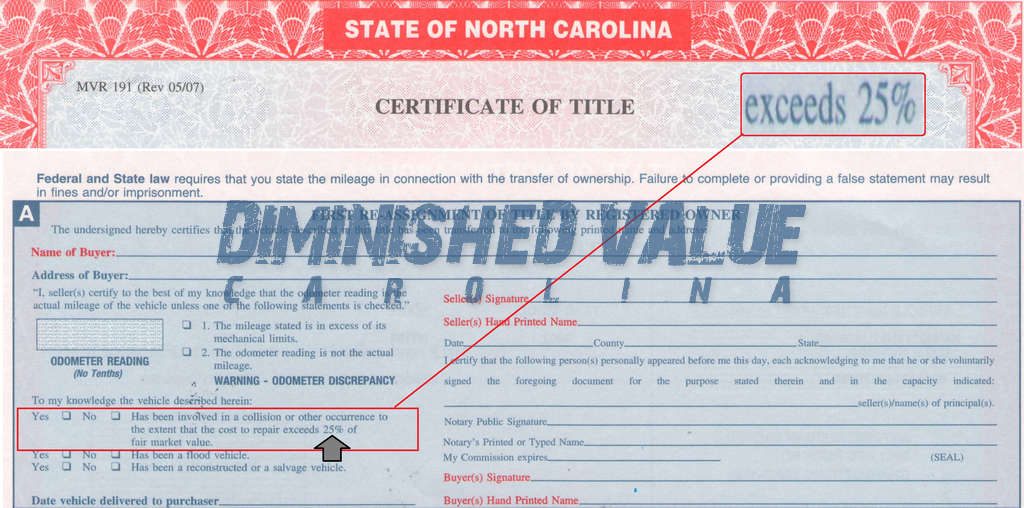

(d1) Such motor vehicle liability policy shall provide an alternative method of determining the amount of property damage to a motor vehicle when liability for coverage for the claim is not in dispute. For a claim for property damage to a motor vehicle against an insurer, the policy shall provide that if:

(1) The claimant and the insurer fail to agree as to the difference in fair market value of the vehicle immediately before the accident and immediately after the accident; and

(2) The difference in the claimant’s and the insurer’s estimate of the diminution in fair market value is greater than two thousand dollars ($2,000) or twenty‑five percent (25%) of the fair market retail value of the vehicle prior to the accident as determined by the latest edition of the National Automobile Dealers Association Pricing Guide Book or other publications approved by the Commissioner of Insurance, whichever is less, then on the written demand of either the claimant or the insurer, each shall select a competent and disinterested appraiser and notify the other of the appraiser selected within 20 days after the demand. The appraisers shall then appraise the loss. Should the appraisers fail to agree, they shall then select a competent and disinterested appraiser to serve as an umpire. If the appraisers cannot agree upon an umpire within 15 days, either the claimant or the insurer may request that a magistrate resident in the county where the insured motor vehicle is registered or the county where the accident occurred select the umpire. The appraisers shall then submit their differences to the umpire. The umpire then shall prepare a report determining the amount of the loss and shall file the report with the insurer and the claimant. The agreement of the two appraisers or the report of the umpire, when filed with the insurer and the claimant, shall determine the amount of the damages. In preparing the report, the umpire shall not award damages that are higher or lower than the determinations of the appraisers. In no event shall appraisers or the umpire make any determination as to liability for damages or as to whether the policy provides coverage for claims asserted. The claimant or the insurer shall have 15 days from the filing of the report to reject the report and notify the other party of such rejection. If the report is not rejected within 15 days from the filing of the report, the report shall be binding upon both the claimant and the insurer. Each appraiser shall be paid by the party selecting the appraiser, and the expenses of appraisal and umpire shall be paid by the parties equally. For purposes of this section, “appraiser” and “umpire” shall mean a person who as a part of his or her regular employment is in the business of advising relative to the nature and amount of motor vehicle damage and the fair market value of damaged and undamaged motor vehicles.