Historic Peak: Average Age of US Light Vehicles (PDF)

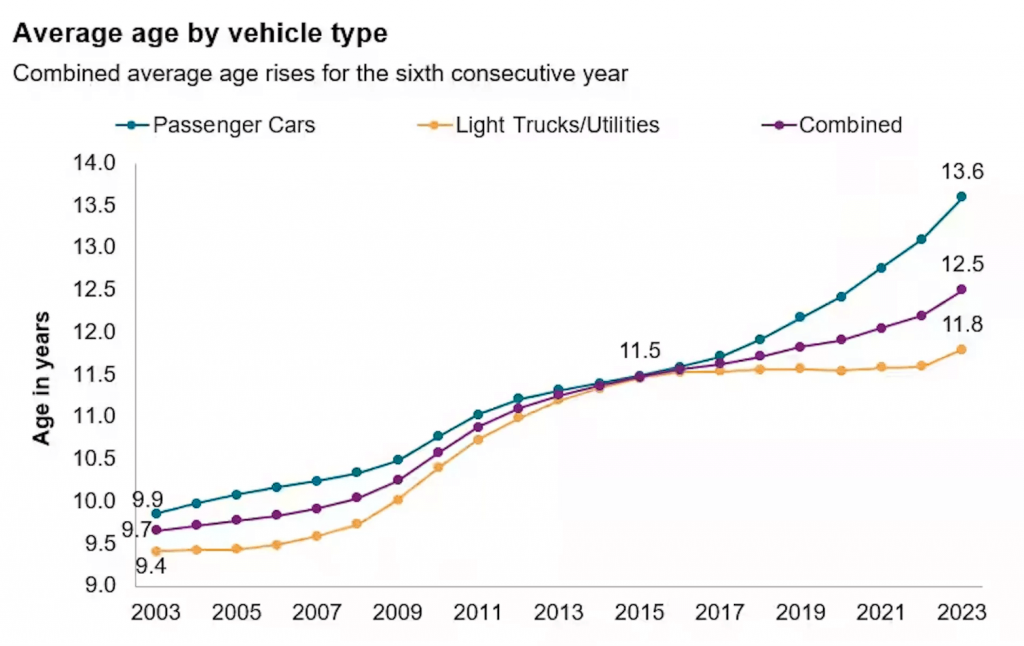

Auto parts retailers across the United States have every reason to raise their glasses in celebration as American drivers are holding onto their cars longer than ever before. A recent report by S&P Global Mobility highlights the combination of low supply and rising prices as the key factors behind this trend. As a result, the average age of vehicles in the U.S. has reached a record high of 12.5 years, marking a three-month increase from the previous year. This significant shift in consumer behavior not only presents challenges for the automotive industry but also offers lucrative opportunities for the aftermarket sector.

Impact of the Pandemic and Supply Chain Disruptions

The COVID-19 pandemic played a pivotal role in reshaping transportation preferences, as people shifted from public transportation to personal vehicles. However, manufacturing shutdowns and limited supply led to a surge in the demand for used cars, driving prices up and leaving many consumers with no choice but to opt for even older models. The ongoing war in Ukraine further exacerbated the situation, disrupting the supply of semiconductors and causing a ripple effect throughout the vehicle supply chain. As a result, the prices of new cars skyrocketed, compelling more Americans to hold onto their current vehicles.

The Changing Landscape of the Automotive Industry

The rise in the average age of vehicles is not solely attributed to consumer choices. S&P Global Mobility’s analysis reveals that passenger cars, including sedans, coupes, wagons, and hatchbacks, have been the primary drivers of the increase in the average used car age. In contrast, light-duty trucks and SUVs have experienced relatively consistent average age growth. Interestingly, despite the overall trend, the introduction of more affordable electric vehicles (EVs) coupled with federal and state tax incentives has helped boost new EV sales. This may lead to an influx of newer vehicles in the coming years, potentially altering the average age trajectory.

Opportunities for the Aftermarket Sector

The aging fleet of vehicles presents significant opportunities for the vehicle service industry. Older vehicles require frequent repair work and maintenance, resulting in increased demand for auto parts and services. The aftermarket sector, closely following the growth of average vehicle age, has witnessed substantial revenue growth. Estimates from the S&P Global Channel Forecast, in collaboration with the Auto Care Association and MEMA Aftermarket Suppliers, project a notable increase in revenue for the U.S. light-duty aftermarket. This growth is driven by consumers investing more in keeping their aging vehicles running efficiently.

Future Outlook

Despite economic headwinds, S&P Global Mobility forecasts a rebound in new vehicle sales, with projections exceeding 14.5 million units in 2023. This optimistic outlook may help slow down the rate of average age growth in the upcoming year. Moreover, the shift in consumer preferences towards light trucks and utilities presents an additional opportunity for the vehicle service industry. Light trucks, known for higher maintenance costs and longer ownership cycles, contribute to a positive trend for the aftermarket sector.

As more American drivers hold onto their cars for longer periods, the average age of vehicles on U.S. roads has reached unprecedented levels. The interplay of low supply, rising prices, and changes in consumer behavior has reshaped the automotive landscape. While the challenges faced by the industry are significant, this trend has presented a silver lining for auto parts retailers and the aftermarket sector. As the demand for repair work and maintenance surges, the vehicle service industry stands to benefit from this aging fleet of vehicles. Moving forward, the automotive industry and aftermarket sector must adapt to this shifting paradigm to meet the evolving needs of American drivers.