Download HERE The: “Diminished Value: The Ultimate Guide” PDF

Have you ever wondered why your car’s value drops significantly after an accident, even if it’s perfectly repaired? This phenomenon is known as diminished value.

Whether you’re a car owner or an insurance claimant, understanding diminished value can help you secure the compensation you deserve.

In this comprehensive guide, we’ll walk you through everything you need to know about diminished value—from its history and types to step-by-step instructions for filing a claim.

Plus, we’ll show you how to guarantee your free estimate with Diminished Value Carolina!

Why Should You Care About Diminished Value?

After an accident, even if your car looks as good as new, its market value can take a substantial hit.

This reduction in value is what we call diminished value.

It can impact your financial situation, particularly if you intend to sell the vehicle or if it is involved in another accident in the future.

Insurance companies often don’t volunteer this information, and many car owners miss out on significant compensation because they aren’t aware of their rights.

By understanding and claiming it, you can ensure you are fairly compensated for the loss in value of your vehicle.

The Brief History of Diminished Value

The concept of diminished value has been around for decades, evolving alongside the insurance industry.

Initially, appraisals were conducted by local mechanics and car dealers who estimated a vehicle’s value based on their expertise.

However, as the insurance industry grew, the need for a more formalized process became evident.

Early Developments

In the mid-20th century, professional organizations like the American Society of Appraisers (ASA) began to establish standards and certifications to ensure accuracy and fairness in vehicle appraisals.

This was a significant development because it provided a standardized method for assessing the value of vehicles post-accident.

Significant Legal Cases

Several landmark legal cases have shaped the understanding and application of diminished value claims.

One notable case is Mabry v. State Farm Mutual Auto Insurance Company, where the Georgia Supreme Court ruled that policyholders are entitled to compensation for diminished value even if their vehicle has been fully repaired.

This case set a precedent and increased awareness about the concept of diminished value.

Modern Application

Today, these claims are a recognized part of the insurance landscape, although not all claimants are aware of their rights.

The methods for calculating have also evolved, incorporating more sophisticated approaches to ensure fair compensation.

According to the article “Diminished Value Claims: Assessing Vehicle Value After Accidents” by Smith and Johnson (2018), these methods have significantly improved accuracy in determining post-accident vehicle values.

Quick Diminished Value Guide

What is Diminished Value?

Diminished value refers to the reduction in a vehicle’s market value after it has been involved in an accident and subsequently repaired.

Even if a car is restored to its pre-accident condition, its history of damage can affect its resale value.

Why Does Diminished Value Matter?

When you try to sell a vehicle that has been in an accident, potential buyers may offer less money because of its accident history.

Even with perfect repairs, the stigma associated with a damaged vehicle can lead to a lower resale value.

This loss in value is what you can claim from your insurance company, provided you know how to go about it.

Types of Diminished Value

| Type | Description | Scenario | Formula | Example |

|---|---|---|---|---|

| Immediate | The difference in resale value immediately after an accident, before any repairs are made. | A car with visible damage from a collision, yet to be repaired. | Not typically calculated as a separate formula. | $20,000 – $6,000 = $14,000 |

| Inherent | The loss in value due to the vehicle’s accident history, even after it has been repaired to its original condition. | A car repaired perfectly but has a recorded accident history. | (Pre−Accident Value) – (Post−Repair Value) | $20,000 – $16,000 = $4,000 |

| Repair-Related | The loss in value resulting from improper or substandard repairs. | A car with mismatched paint or low-quality repair work that is noticeable upon close inspection. | Dependent on repair quality, often calculated as part of inherent diminished value. | $16,000 (Post-Repair Value if repairs were done properly) – $14,000 (Actual Post-Repair Value) = $2,000 |

Immediate diminished value is the reduction in value right after an accident, inherent diminished value is the loss due to the accident history even after repairs, and repair-related diminished value is the loss resulting from poor repairs.

Understanding these distinctions can help you better assess and claim the diminished value of your vehicle.

Step-by-Step Guide to Claiming Diminished Value

Step 1: Assess the Damage

- Initial Inspection: After an accident, thoroughly inspect your vehicle and document all visible damage with photographs. This is crucial as it provides the initial evidence of the extent of the damage.

- Professional Appraisal: Obtain an initial damage assessment from a certified appraiser to understand the extent of the damage. A professional appraisal can provide a detailed report that will be essential for your claim.

Why Documentation is Crucial

Having detailed documentation from the outset can make or break your claim.

Photos, repair estimates, and professional appraisals create a solid foundation for arguing your case with the insurance company.

Without this evidence, your claim may be significantly undervalued or denied altogether.

Step 2: Get a Repair Estimate

- Choosing a Repair Shop: Select a reputable repair shop to ensure quality repairs. Look for shops that are certified by recognized organizations such as the National Institute for Automotive Service Excellence (ASE).

- Detailed Estimate: Request a detailed repair estimate, including parts, labor, and any potential hidden damages. Ensure that the estimate is itemized, as this will help in substantiating your claim.

Tips for Choosing a Repair Shop

- Check Reviews: Look for reviews and ratings from previous customers.

- Certifications: Ensure the shop is certified and has experienced technicians.

- Warranty: Ask if the repairs come with a warranty.

Step 3: Obtain a Diminished Value Estimate

Certified Appraiser: Hire a certified appraiser to determine the diminished value of your vehicle.

Experts like Tony Rached, founder of Appraisal Engine, emphasize the importance of a thorough assessment:

“Understanding the true diminished value of a vehicle requires a thorough assessment of both the damage and the market conditions, which is why a detailed appraisal is crucial.”

Diminished Value Carolina: Use DVC’s services to guarantee a fair and accurate estimate.

Why Choose a Certified Appraiser?

Certified appraisers follow industry standards and provide detailed, unbiased reports.

Their expertise can significantly strengthen your claim and ensure you get the compensation you deserve.

As Steven J. Babinski, President of Auto Appraise Inc., points out:

“Diminished value can significantly impact a vehicle’s resale potential. It’s essential for owners to document and claim this loss accurately to ensure fair compensation.”

Step 4: File a Diminished Value Claim

- Insurance Claim: Submit the estimate along with your repair estimate to your insurance company. Make sure to follow the specific procedures outlined by your insurer to avoid any delays.

- Claim Documentation: Provide all necessary documentation, including accident reports, repair bills, and the appraisal report. The more thorough your documentation, the stronger your claim will be.

Key Documents for Filing a Claim

- Accident report

- Repair estimate

- Photos of the damage

- Appraisal report

- Communication logs with the insurer

Step 5: Negotiation and Settlement

- Negotiation Tips: Be prepared to negotiate with your insurance adjuster. Highlight the thoroughness of your documentation and the credentials of your appraiser.

- Seek Legal Advice: If negotiations stall, consider seeking legal advice to ensure you receive fair compensation.

Common Tactics Used by Insurance Companies

Insurance companies may try to downplay the value of your claim or use lowball offers.

Being well-prepared and having a detailed appraisal can counter these tactics.

Don’t be afraid to stand your ground and, if necessary, consult with a lawyer who specializes in diminished value claims.

Data and Statistics

Importance of Diminished Value Claims

- Prevalence: According to a study by Smith and Johnson (2018), diminished value claims are becoming increasingly common as more vehicle owners become aware of their rights.

- Impact on Resale Value: Statistics show that vehicles involved in accidents can lose up to 30% of their market value, even after quality repairs.

Supporting Data and Studies

- A report by the Insurance Information Institute found that the average diminished value claim amounts to approximately $1,500, but can vary widely based on the vehicle and extent of damage (Rodriguez & Thompson, 2019).

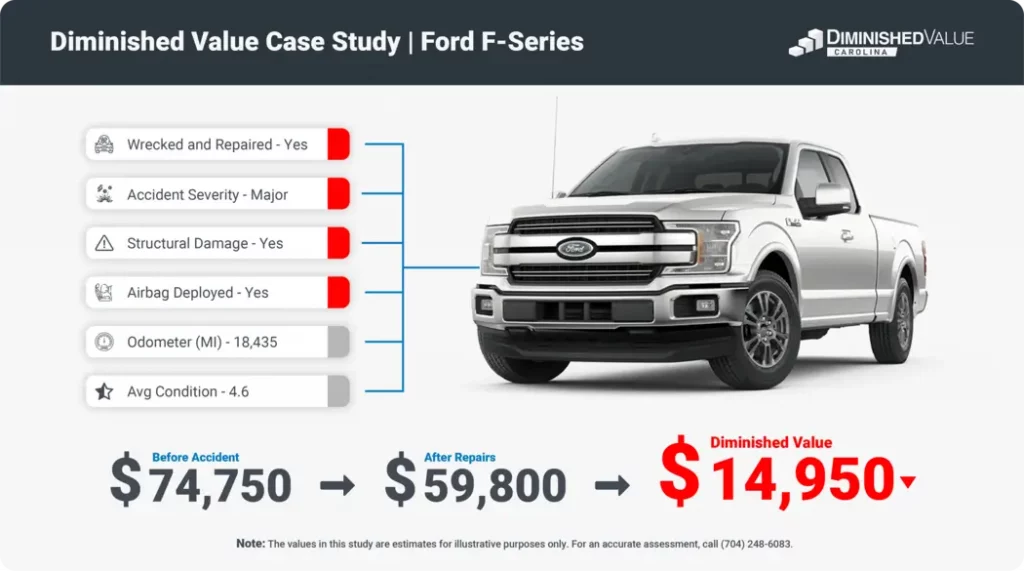

Case Studies

- Case Study 1: A car owner in North Carolina successfully claimed $4,000 after a major accident, using detailed documentation and a certified appraisal.

- Case Study 2: In Georgia, a claimant received a $5,500 settlement for diminished value by leveraging expert witness testimony and comprehensive appraisal reports.

Lessons from Real Cases

These case studies highlight the importance of thorough documentation and professional appraisals.

They demonstrate that with the right preparation and knowledge, claimants can secure substantial compensation for their diminished value claims.

Formulas for Calculating Diminished Value

Understanding the different methods for calculating diminished value can help you choose the most accurate and fair approach:

| Method | Description | Pros | Cons | Formula | Formula Example |

|---|---|---|---|---|---|

| 17c Formula | A formula often used by insurance companies. It calculates diminished value based on a percentage of the vehicle’s pre-accident value, adjusted for damage severity and mileage. | Simple and quick to apply. | Often results in lower estimates, not considering individual market factors. | (Pre−Accident Value) x 0.10 x (Damage Multiplier) x (Mileage Multiplier) | ($20,000) x 0.10 x (0.50) x (0.80) = $800 |

| Market Comparison Approach | Compares the sale prices of similar vehicles with and without accident histories. | Provides a more accurate reflection of market conditions. | Requires access to detailed market data and comparable sales. | (Average Value of Comparable Non−Accident Vehicles) – (Average Value of Comparable Accident Vehicles) | $20,000 (Non-Accident Value) – $16,000 (Accident Value) = $4,000 |

| Expert Appraisal | Involves a detailed assessment by a certified appraiser who considers all factors affecting the vehicle’s value post-repair. | Most accurate and tailored to the specific vehicle. | Can be time-consuming and more costly. | Dependent on appraiser’s detailed assessment of the vehicle. | Varies based on individual vehicle assessment. |

| Tony’s Methodology | Uses a proprietary and detailed approach to assess the true diminished value, considering market conditions and specific vehicle details. | Highly accurate and comprehensive. | May require detailed documentation and can be more complex. | Proprietary formula tailored to individual cases. | Varies based on comprehensive vehicle and market analysis. |

The 17c formula is often criticized for its simplicity and lower estimates, while market comparison and expert appraisal methods are more accurate but require detailed data and professional input.

Tony’s methodology offers a highly comprehensive approach, ensuring a fair and accurate valuation.

Impact of Diminished Value on Vehicle Resale Value

This chart illustrates how diminished value can significantly affect the resale value of your vehicle:

| Vehicle Condition | Resale Value Before Accident | Resale Value After Accident | Diminished Value |

|---|---|---|---|

| No Accident History | $20,000 | $20,000 | $0 |

| Accident History (Repaired) | $20,000 | $16,000 | $4,000 |

The formula “(Pre−Accident Value) – (Post−Accident)” is straightforward and helps illustrate the financial loss that diminished value represents.

Most Reliable Appraisers List

Top Appraisers for Diminished Value Claims

- Diminished Value Carolina

- Specializes in diminished value and total loss appraisals.

- Uses a detailed, proprietary methodology to ensure accurate valuations.

- Offers comprehensive support throughout the claims process.

- Diminished Value of Georgia

- Founded by expert Tony Rached, known for his thorough assessments and reliable appraisals.

- Provides detailed reports and expert testimony if needed.

- Car Appraisals & Claims LLC

- Offers personalized service and comprehensive appraisal reports.

- Specializes in total loss and diminished value appraisals.

- Appraisal Engine Inc.

- Known for providing detailed and transparent appraisal reports.

- Specializes in total loss and diminished value claims.

- Benchmark Auto Appraisers

- Provides comprehensive appraisal services for all types of vehicles.

- Known for their detailed reports and professional approach.

Why Choose These Appraisers?

These appraisers are recognized for their expertise, thoroughness, and reliability.

They provide detailed, accurate appraisals that can significantly strengthen your claim.

Carolina Variations

Unique Aspects of Filing in Carolina

- State Regulations: North and South Carolina have specific regulations governing the claims. Understanding these regulations is crucial for a successful claim.

- Local Tips: Ensure you are familiar with state-specific filing requirements and deadlines. Consulting with local experts like DVC can provide a significant advantage.

State-Specific Considerations

- North Carolina: Requires detailed documentation and a clear demonstration.

- South Carolina: Emphasizes the importance of professional appraisals and may have different claim filing procedures.

Consulting with Local Experts

Local experts are familiar with state regulations and can provide invaluable advice and support throughout the claims process.

They can help ensure all documentation is in order and that the claim is filed correctly and on time.

Conclusion

Understanding and claiming diminished value is crucial for ensuring you are fairly compensated after an accident.

By following this comprehensive guide, you can navigate the process confidently and effectively.

Why Act Now?

The sooner you act, the better your chances of securing fair compensation.

Delaying your claim can result in lower valuations and more challenging negotiations with insurance companies.

Take the first step today and ensure your rights are protected.

Frequently Asked Questions (FAQs)

What is diminished value?

Diminished value is the reduction in a vehicle’s market value after it has been involved in an accident and subsequently repaired.

How much should I get for diminished value?

The amount varies based on the severity of the damage, the vehicle’s pre-accident value, and the quality of repairs, but the diminished value amount would typically fall between 10% to 25% of the vehicle’s fair market value.

How to get a diminished value appraisal?

Hire a certified appraiser or use services like DVC for a professional assessment.

How is diminished value calculated?

Methods include the 17c formula, market comparison approach, and detailed expert appraisals.

Why is the 17c formula controversial?

It often undervalues vehicles by not fully considering individual market factors and the true impact of an accident on resale value.