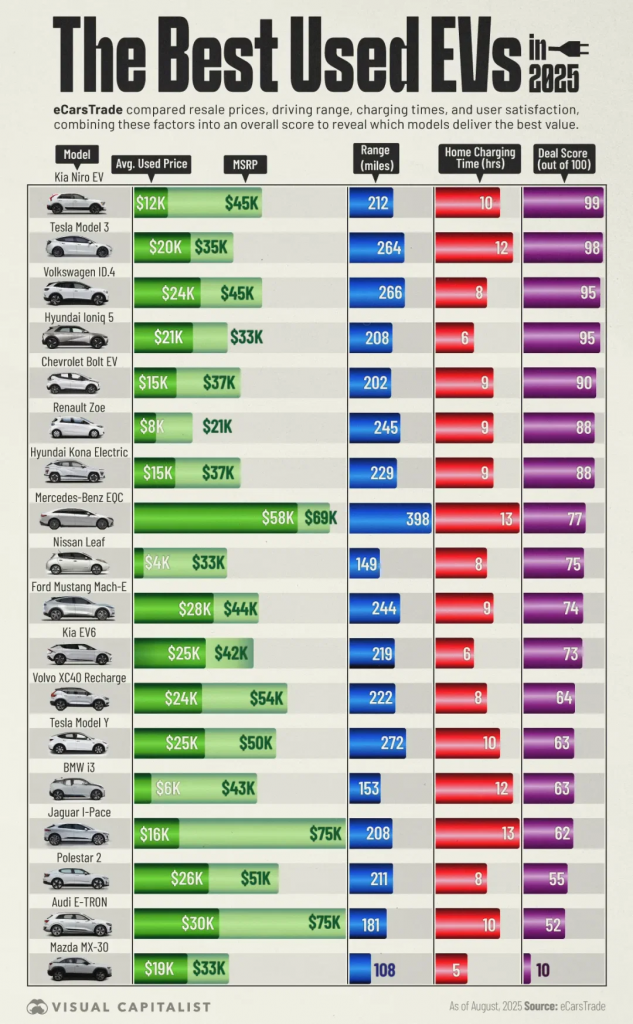

Electric vehicles continue growing in popularity, and the used EV market in 2025 is finally reaching the point where buyers can find strong deals without sacrificing range, reliability, or charging performance.

Using data from eCarsTrade and Visual Capitalist, here is a clear, appraiser-level analysis of which used EVs deliver the best value this year, and what these numbers tell us about long-term depreciation and resale strength.

As an independent licensed auto appraiser, I’m looking at these results from the perspective of value retention, real-world market behavior, and how EV depreciation plays into future diminished-value claims.

Key Takeaways

- The Kia Niro EV and Tesla Model 3 rise to the top as the best overall used-EV values, balancing range, resale, and price accessibility.

- EVs with longer ranges (250+ miles) continue to score much higher, proving that range anxiety still shapes used-market demand.

- The used EV market is officially maturing: strong resale performance is aligning closely with real-world desirability and charging practicality.

The Best Used EVs of 2025

Top Models by Overall Value Score

Based on resale price, range, charging time, and user satisfaction, here are the standout performers:

| Model | Avg. Used Price | MSRP | Range (miles) | Home Charging Time (hrs) | Value Score |

|---|---|---|---|---|---|

| Kia Niro EV | $12K | $45K | 212 | 10 | 99 |

| Tesla Model 3 | $20K | $35K | 264 | 12 | 95 |

| Volkswagen ID.4 | $24K | $45K | 266 | 8 | 94 |

| Hyundai Ioniq 5 | $21K | $33K | 208 | 6 | 92 |

| Chevrolet Bolt EV | $15K | $37K | 259 | 9 | 89 |

| Renault Zoe | $20K | $17,400 | 245 | 9 | 88 |

| Hyundai Kona Electric | $27,485 | $40,830 | 229 | 9 | 86 |

| Mercedes-Benz EQC | $58,985 | $75,474 | 398 | 13 | 77 |

| Nissan Leaf | $23,760 | $33K | 149 | 8 | 76 |

| Ford Mustang Mach-E | $44,395 | $52,825 | 244 | 11 | 74 |

| Kia EV6 | $42,715 | $52,300 | 289 | 6 | 73 |

| Volvo XC40 Recharge | $39,980 | $44,000 | 222 | 8 | 64 |

| Tesla Model Y | $30,000 | $21,000 | 272 | 10 | 62 |

| BMW i3 | $43,350 | $36,000 | 153 | 12 | 63 |

| Jaguar I-Pace | $75,000 | $75,970 | 208 | 13 | 62 |

| Polestar 2 | $20,000 | $24,240 | 211 | 8 | 61 |

| Audi E-Tron | $71,840 | $30,000 | 181 | 10 | 52 |

| Mazda MX-30 | $13,470 | $19,800 | 108 | 5 | 50 |

Expert Appraiser Insights on These Rankings

Here’s what stands out when viewing these numbers through a value-retention and depreciation lens:

1. Range is still the king of used-EV value.

Models above 250 miles consistently outrank shorter-range competitors. Buyers are still willing to pay more for the convenience and practicality of longer range, even when the EV is several years old.

2. Early EVs with small batteries (Leaf, MX-30, i3) continue to suffer steep depreciation.

These vehicles dropped sharply in market value because their range no longer matches modern expectations. Their resale disadvantage is structural, not temporary.

3. Tesla remains the benchmark for “EV desirability.”

Even with price drops and higher used-market inventory, the Model 3 and Model Y are top performers thanks to range, software, charging availability, and ongoing updates.

4. Luxury EVs depreciate the hardest.

Models like the Mercedes EQC, Audi E-Tron, and Jaguar I-Pace still see extremely steep value drops due to:

- expensive battery repairs

- high MSRP

- limited buyer demand in the used market

- high ownership costs

This is consistent across the country and unlikely to change soon.

How These Findings Compare to the 2022–2023 Gas & Hybrid Rankings

To put these EV results in context, here’s how they stack up against the earlier rankings of the slowest-depreciating gasoline vehicles:

Gas & Hybrid Leaders (2022 Models)

- Toyota Corolla Cross

- Toyota 4Runner

- Toyota Tacoma

- Subaru Crosstrek

- Honda Civic

These models showed depreciation as low as 2.6% to 5% over three years, which is dramatically better than most EVs.

Comparison Takeaways

- EVs still depreciate faster overall, mainly due to rapid tech change and uncertainty around long-term battery cost.

- However, the best EVs (Niro EV, Model 3, ID.4) are now reaching depreciation levels closer to compact SUVs and sedans.

- Range is the biggest differentiator: EVs with long range hold value much better, narrowing the depreciation gap.

EV resale value is improving, just not at the level of Toyota’s gas lineup yet.

What This Means for Diminished Value Claims

Depreciation is directly tied to how diminished value behaves after a collision. Here’s how EVs differ:

1. EVs can experience higher DV because buyers are more fearful of post-accident battery issues.

Even perfectly repaired EVs may suffer a larger stigma in the used market.

2. Long-range EVs (250+ miles) lose more resale value after an accident.

Because they already retain value better, the resale penalty is steeper when damage enters the vehicle history.

3. Luxury EVs often suffer the highest DV percentages

Their resale value drops fast, and damage accelerates that decline even more.

4. Battery health is a major factor

If an accident affects the battery pack area, even cosmetically, market fear increases the post-repair value loss.

Simply put: EVs can have stronger DV claims than buyers (and insurers) expect.

Final Thoughts

The used EV market in 2025 is healthier, more competitive, and providing far better value than it did just a few years ago. Models like the Tesla Model 3, Kia Niro EV, VW ID.4, and Hyundai Ioniq 5 now combine smart pricing with strong performance and growing buyer trust.

But with higher resale sensitivity comes higher diminished value after an accident, something insurers rarely calculate correctly without a professional appraisal.

Get a Free Diminished Value Estimate for Your EV

If your EV was in an accident and now has a repaired title, you may be entitled to a significant diminished value claim. Take 30 seconds to request your free estimate:

👉 Start Your Free EV Diminished Value Estimate

We’ll analyze your vehicle, battery health considerations, and real market data to determine exactly how much value you lost.